Recently you too have heard of Iliad, the new mobile telephone operator that has landed in Italy between the end of May and the beginning of June. Indeed, it is probably difficult that you have never heard of it. Iliad is in fact riding a wave of remarkable success and continues to receive so many registration requests that it has some difficulties in meeting them. New users are looking forward to abandoning their old operator to become part of the #Revolution.

What’s behind this success? Which marketing and communication tools did Iliad use to approach potential customers? Behind great success there is always great attention to detail, which in this case has also meant listening to the needs of people to provide them with original and differentiating solutions on the market. In this article we will try to give some answers.

The numbers of Iliad

According to the estimates of the German Berenberg Bank, there is talk of about 350 thousand SIM cards sold in a month, that is 10 thousand new users every day! Despite this, however, the #Revolution was not totally devoid of discussion and controversy concerning above all the quality of the signal and the perfectible network and the extension of the coverage that does not reach the levels of the direct competitors.

Iliad: the newest thing beats what is just new

At this point a curious mind will ask why and how such a phenomenon. Looking for answers, surely the first that comes to mind is that the strength test of the new operator is basically based on economic competitiveness of the offer but, if more attention is paid and does not stop us at the macroscopic level, there are also more refined and less explicit mechanisms and strategies that have played an important role in determining Iliad’s success.

Among the latter, the brand has used “levers” to differentiate itself from its competitors, promoting its offer as a service of absolute transparency, without hidden or unexpected additional costs, without scams or risks of any kind and have associated their brand with simplicity, to the transparency and finally, to the “economic” security of users.

Despite the general quality of the service, for its youth and for the speed with which it was set up, it does not seem comparable to that of other Italian telephone companies, thousands continue to decide to change and some surveys show that even more than 70% of those who have already done so are satisfied and would do it again.

People’s assessments in choosing Iliad

In this context it can be useful and have a clarifying role to consider the ideas of Daniel Kahneman, an Israeli psychologist expert in choice theories and decision processes, creator of what is called “behavioral economics” and winner of the Nobel Prize for economics in 2002. Kahneman is known to have succeeded in integrating psychological breakthroughs into economic science, with particular reference to human judgment and decision-making in the event of uncertainty.

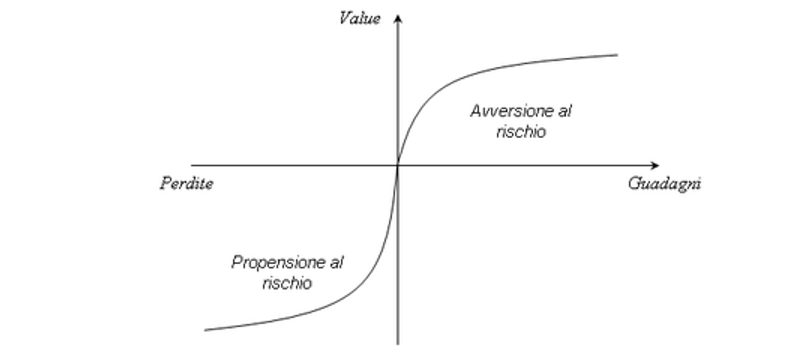

According to Kahneman and his collaborators in the “Prospect Theory“, in making decisions, people follow a model of subjective value and are influenced by the way the message is communicated (effect “Framing”) without being fully aware of it.

In this model of judgment and decision-making, people:

- They perceive the different options in terms of potential gains (gains) or potential losses (losses) with respect to a neutral reference point;

- consider the most important and heavy losses of the corresponding gains (loss aversion –risk aversion);

- they are more likely to make risky choices in the domain of losses, but not in that of earnings, where instead they prefer certainty at the cost of not earning the maximum possible.

In this context it can be useful and have a clarifying role to consider the ideas of Daniel Kahneman, an Israeli psychologist expert in choice theories and decision processes, creator of what is called “behavioral economics” and winner of the Nobel Prize for economics in 2002. Kahneman is known to have succeeded in integrating psychological breakthroughs into economic science, with particular reference to human judgment and decision-making in the event of uncertainty.

According to Kahneman and his collaborators in the “Prospect Theory“, in making decisions, people follow a model of subjective value and are influenced by the way the message is communicated (effect “Framing”) without being fully aware of it.

In this model of judgment and decision-making, people:

- They perceive the different options in terms of potential gains (gains) or potential losses (losses) with respect to a neutral reference point;

- consider the most important and heavy losses of the corresponding gains (loss aversion –risk aversion);

- they are more likely to make risky choices in the domain of losses, but not in that of earnings, where instead they prefer certainty at the cost of not earning the maximum possible.

In this context it can be useful and have a clarifying role to consider the ideas of Daniel Kahneman, an Israeli psychologist expert in choice theories and decision processes, creator of what is called “behavioral economics” and winner of the Nobel Prize for economics in 2002. Kahneman is known to have succeeded in integrating psychological breakthroughs into economic science, with particular reference to human judgment and decision-making in the event of uncertainty.

According to Kahneman and his collaborators in the “Prospect Theory“, in making decisions, people follow a model of subjective value and are influenced by the way the message is communicated (effect “Framing”) without being fully aware of it.

In this model of judgment and decision-making, people:

- They perceive the different options in terms of potential gains (gains) or potential losses (losses) with respect to a neutral reference point;

- consider the most important and heavy losses of the corresponding gains (loss aversion –risk aversion);

- they are more likely to make risky choices in the domain of losses, but not in that of earnings, where instead they prefer certainty at the cost of not earning the maximum possible.

In this context it can be useful and have a clarifying role to consider the ideas of Daniel Kahneman, an Israeli psychologist expert in choice theories and decision processes, creator of what is called “behavioral economics” and winner of the Nobel Prize for economics in 2002. Kahneman is known to have succeeded in integrating psychological breakthroughs into economic science, with particular reference to human judgment and decision-making in the event of uncertainty.

According to Kahneman and his collaborators in the “Prospect Theory“, in making decisions, people follow a model of subjective value and are influenced by the way the message is communicated (effect “Framing”) without being fully aware of it.

In this model of judgment and decision-making, people:

- They perceive the different options in terms of potential gains (gains) or potential losses (losses) with respect to a neutral reference point;

- consider the most important and heavy losses of the corresponding gains (loss aversion –risk aversion);

- they are more likely to make risky choices in the domain of losses, but not in that of earnings, where instead they prefer certainty at the cost of not earning the maximum possible.

So on the one hand people are more willing to accept risky situations (they are risk seeking) when options are presented in terms of possible losses or negative consequences (loss frame); on the other they prefer certain situations (they are risk averse) when the same options are presented in terms of possible benefits or positive consequences (gain frame).

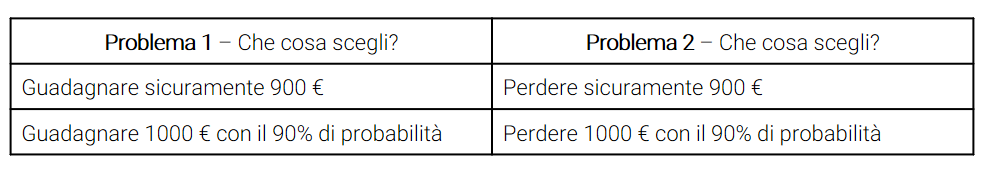

For example:

1. In the first case, the subjective value of a gain of €900 is greater of a gain of €1000 with 90% probability, because it is sure.

2. In the second case instead, being the subjective value of certain loss very aversive for people, it is possible that these tend to run the risk.

Behavioral economics to understand the communication levers of Iliad

With this model in mind it is possible to observe the Iliad phenomenon from a different point of view. The new operator succeeded in present information to the public in a format of potential benefit (transparency, simplicity and reliability) compared to the potential costs of competitors, such as scams, hidden costs or lack of transparency to which people are unfortunately accustomed. With this type of communication, Iliad has not only succeeded in differentiating itself positively on the market, but has taken into account both the influences and the presentation methods (frames) of the information exercised on the decision making and of the subjective value of people when they make a judgment and make a decision.

The studies of Kahneman and other authors who have dealt with decision-making processes, provide valuable insights and communication tools: the possibility of influence people’s choices selecting descriptions of the problem that favor some alternatives with respect to others represents an opportunity and at the same time a challenge.

Meeting people’s expectations and giving them adequate solutions means giving value to their overall experience, allowing them to make objective choices based on transparency. The lesson of Iliad teaches us that the way in which the benefits of a product are presented is important, and that they are received and re-proposed with real transparency.

Bibliography:

- Kahneman, D., & Tversky, A. (1979). On the interpretation of intuitive probability: A reply to Jonathan Cohen.

- Kahneman, D., & Tversky, A. (2013). Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I (pp. 99-127).

- Thaler, R. H., Tversky, A., Kahneman, D., & Schwartz, A. (1997). The effect of myopia and loss aversion on risk taking: An experimental test. The Quarterly Journal of Economics, 112(2), 647-661.

- Kahneman, D., & Tversky, A. (2013). Choices, values, and frames. In Handbook of the Fundamentals of Financial Decision Making: Part I (pp. 269-278).

A heartfelt thanks for this article to Nicola Bartoli, who in recent months has been involved in research with the TSW Experience team and has contributed to this article.